From the 1st of November 2020 the new Job support scheme will come into force.

The Coronavirus Job retention scheme (current furlough scheme) is coming to an end on the 31st October 2020.

As with all the CJRS rules, there will be more clarity on the rules in the coming days. The government announced it will significantly increase the generosity and reach of its winter support schemes to ensure livelihoods and jobs across the UK continue to be protected in the difficult months to come, supporting jobs and helping to contain the virus.

Which employers can use the new scheme?

SME can use the scheme, regardless of sector. Larger companies will have to demonstrate financial difficulties due to Covid-19 via a financial assessment.

Which employees are eligible?

Any employee for whom you have made a real time submission (RTI)to HMRC, they must have been employed by you on the payroll before the 23rd of September 2020. Recent new starters are unlikely to eligible – if you ran your payroll prior to the 23rd they will be eligible…

Can employees who were not on furlough be eligible for this scheme.

Yes, as long as they are on your payroll at the 23rd September 2020.

How long will this scheme be valid for?

The scheme will commence on the 1st November 2020 and will run until the end of April 2021, and covers the whole of the UK.

How does it work?

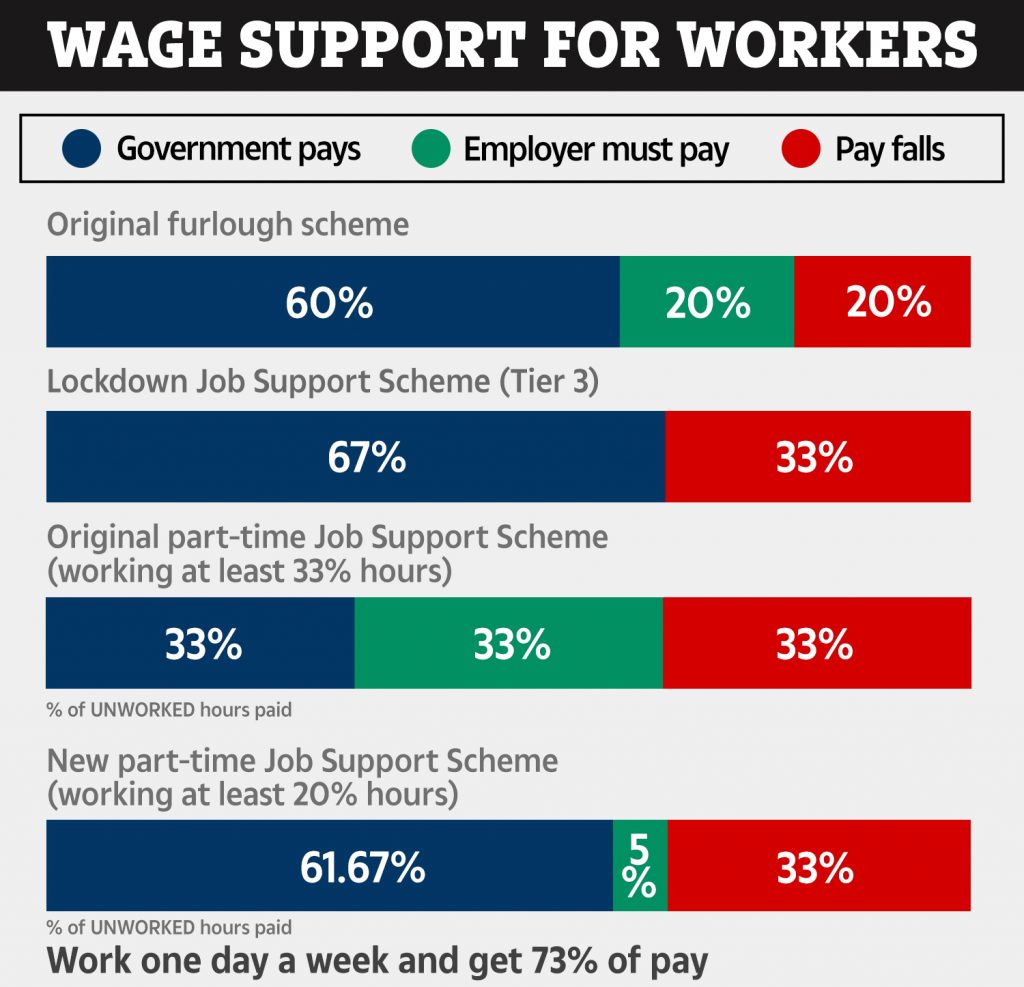

When originally announced, the JSS saw employers paying a third of their employees’ wages for hours not worked, and required employers to be working 33% of their normal hours.

Today’s announcement reduces the employer contribution to those unworked hours to just 5%, and reduces the minimum hours requirements to 20%, so those working just one day a week will be eligible. That means that if someone was being paid £587 for their unworked hours, the government would be contributing £543 and their employer only £44.

Is there a limit on the government funding?

There is a cap of £1541.75 per employee per month.

Can you still have access to the Job retention bonus as an SME?

Employers using the scheme will also be able to claim the Job Retention Bonus (JRB) for each employee that meets the eligibility criteria of the JRB. This is worth £1,000 per employee.

Taking JSS-Open and JRB together, an employer could receive over 95% of the total wage costs of their employees if they are retained until February.

How about pension and employer NI contributions, will these be covered?

No, these will still be payable by the employer.

What happens if we want to change an employee’s hours to suit the needs of the business?

You will need to agree any changes to the working patterns – consult with the employee; we suggest you document in writing any agreements. You cannot change the hours too much – once agreed they must stay on the arrangement for 7 days, and work 20%of their usual number of hours for the first three months – this will also make it easier to make the payments and claim the money back.

Claiming the money back…

It is likely that you will claim the money back in the same way that you claimed any previous furlough payments. You will be able to claim monies back as of December 2020.

What happens to holidays/accrual and pay?

The guidance is not clear on these issues, we await further instructions.

What happens if I need to make redundancies? Can I still use this scheme?

Employers are not able to use the scheme for anyone who is on notice of redundancy. Once you have confirmed the redundancy and given notice payment of the notice should be made without any assistance from the government.

Need further HR advice?

If you need help with redundancies, drafting appropriate letters, or talking to your employees and documenting contract variations please give us a call, we are here to help. 0118 324 2526.